Future Of Plant-Based Protein: Market Analysis And Tech Solutions

The demand for alternative proteins has never been greater, driving the development of new technology solutions to manufacture innovative proteins and ingredients. The main drivers behind this growth include:

- Growing world population is expected to reach 9.8 billion people over the next 30 years, requiring a reliable and sustainable source for proteins essential to human health.

- Consumer shifts in dietary habits have revealed a new consumer subset, Flexitarians, who realize the benefits of a vegetarian or vegan diet but who still enjoy meat and dairy.

- Sustainability concerns about environmental impacts of inefficient land-use and livestock agriculture, plus concerns due to current livestock practices, are gaining popular attention.

The plant-based protein market, with the key geographic regions of North America, Asia-Pacific, and Europe, is poised for significant growth over the next 3-5 years. To illustrate this growth, here are some key facts:

- The market for alternative proteins like plant-based is expected to grow at 14% annually by 2024, equivalent to almost a third of the total protein market in this time-period.

- US plant-based food market reach USD 7.4 billion in 2021, with global growth forecast of 15.3% CAGR towards 2030 and beyond.

- Many plant-based protein applications are now focused on food ingredients suitable for human consumption. Applications in dietary supplements, cosmetics, pharmaceuticals, and pet food complete the market demand.

- In 2024, the global market for plant-based dairy is anticipated to reach USD 34 billion.

The Advancement of Plant-Based Protein Manufacturing

Historically, plant-based proteins have been produced for animal feed as a low-value by-product of starch or alcohol manufacturing. With the rising demand for alternative proteins, manufacturers have ventured to create high-value proteins aimed for human consumption. Depending on their traditional focus, each type of manufacturer offers a different expertise to plant-based ingredients:

Starch: Manufacturers of various types of starches and sweeteners, including corn wet milling, wheat milling, and other cereal or vegetable processors, are experienced with fractionating crops into the starch, protein, and fiber (and oil in oilseed applications). This expertise translates very well to plant-based proteins by adding a protein purification process. Starch manufacturers can successfully integrate a wet fractionation process into their operations or develop new facilities for manufacturing high-grade protein isolates (85%-95%) and co-product ingredients (fiber & starch).

Agricultural Commodities: Processors of commodity grains have strong experience in bulk grain storage and handling, including milling and blending into specialty flours. To further diversify the product offering to include high-value proteins, this expertise can be integrated into the front-end of a dry fractionation process. These CAPEX-limited projects generally feature air classification methods for fractionation, but have a limited protein concentration capacity suitable for targeting the protein concentrates market (55%-65%). Through some technology innovations, slightly higher protein concentrations are possible. Alternatively, manufacturers can invest additional CAPEX for a wet fractionation process to directly access the higher-value protein isolate market with technical support from experienced partners.

Brewery & Alcohol: Manufacturers of fuel ethanol have been diversifying their products for over 10 years, varying the alcohol grades for new applications and refining the by-product distillers’ dried grains and solubles (DDGS) into a co-product Hi-Protein DDG. These innovations have allowed companies to emerge as Specialty Products manufacturers, including ingredients for feed, food, personal care, and more. In parallel, brewing companies have expanded into the specialty products market by extracting added-value from their waste streams from beer-making, including specialized proteins and feed from spent yeast and spent grains. Both domains offer unique expertise in fermentation technologies, and some manufacturers have started partnering with start-ups who have specialized proprietary protein-extraction processes to support commercialization projects.

What are the current challenges in setting-up projects?

Established manufacturers with existing large-scale processing operations are currently financing or investing in initiatives in plant-based product innovations and process developments. These initiatives include investment support for commercialization studies, installation of self-contained Pilot Plant facilities for R&D testing purposes, or full-scale demonstration plants.

The current challenges to overcome in determining the level-of-involvement or the project criteria are rooted in the relative infancy but rapid evolution of the industry. Given the consensus that plant-based foods are poised to make a significant impact on the world’s food supply, why are new ingredients-manufacturing projects facing cautious optimism?

- Rapidly Changing Marketplace: the industry is heavily promoting alternative meats, such as plant-based burgers, which requires particular protein ingredients and blends for functionality. In the short-term, different proteins with varying functional requirements will be needed for dairy-free or egg-free products depending on the applications and recipes. As the industry settles-in to meet the market demands, flexible process system designs are needed to accommodate current and changing customer needs. Although proven equipment technologies are available, customization and integration into complete overall systems should be tailored for customer-specific requirements.

- Supply and Demand Metrics: a centralized market for emerging plant-based ingredients is needed to establish supply and demand for different protein grades and other ingredients. Current pricing is based on spot-pricing set by existing manufacturers, resulting in some uncertainty among investors. Additionally, operations that have recently started-up have been designed for significantly varying capacities, leading to questions about the “ideal” plant sizes for future projects to meet demand.Investment Costs: where the supply and demand metrics govern the market pricing, there is also a need for more clarity on CAPEX and OPEX costs for establishing a new operation. Project owners and investors are seeking more defined technical support for operating and process requirements to inform reliable and objective budget estimates. Engineering support to develop complete process flowsheets would help to define fundamental requirements.

- Co-Products: although the current conversation is focused on proteins, the feed crops are also comprised of starch (and/or oil), fiber, and other components. Justification of new ingredient manufacturing projects also relies on how to handle or market the co-products from these components.

How can a partnership approach help?

To help navigate these challenges and support the development of ingredients projects, strategic partnerships between process/equipment suppliers (while integrating the customers into the process) would be beneficial in de-risking the opportunities. These inter-vendor partnerships would offer projects a guiding-hand from project genesis to process development, and ultimately through successful execution. This approach is characterized by consultative engineering, R&D, testing, pilot plant validation, and collaborative process design of complete systems from A-to-Z. From grain-handling to milling to processing to packaging. Particular focus for this developing market is placed on new product innovation and product development, which requires flexible Pilot Plant capabilities, as well as testing equipment suitable for scaling-up the process to industrial and commercial size.

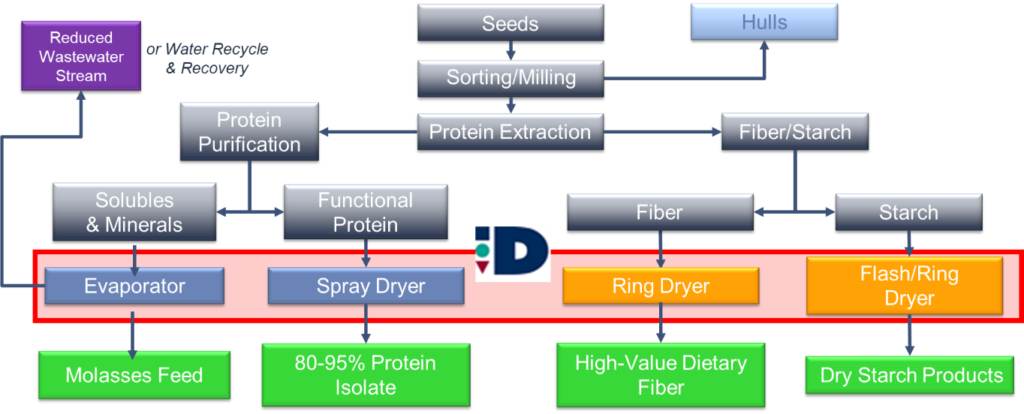

For a given process manufacturing system, Dedert Corporation can be an ideal partner to integrate evaporation and drying technologies such as Spray Drying of protein, Ring Drying of fiber, Flash Drying of starch, and Evaporation (concentration) of solubles. Equipment designs are customized and scaled-up through R&D from our in-house Pilot Plant facilities based on product development, process innovation, and operational optimization.

Summary

The plant-based protein market is evolving faster than we think. Advancements in manufacturing processes and the involvement of experienced manufacturers with complementary expertise are critical to keeping-up with this evolution. However, challenges in developing new projects remain prevalent in the rapidly growing environment and require technical solutions from innovative companies partnering towards successful implementation of new manufacturing facilities. Strategic partnerships between manufacturers, process providers, and equipment suppliers is important to successfully implement a holistic approach to optimize a process design with a seamlessly integrated process solution. This approach opens opportunities to lower the cost of operations and therefore provide easier access-to-market for new product innovations that meet changing customer expectations in a growing industry.